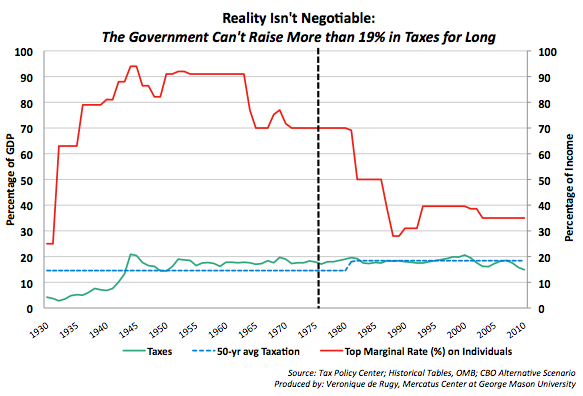

Don't believe me? Here's a scientific looking graph to prove it:

And here's source of the graph.

So, tax the rich, tax the middle class, pass the Fair Tax, it doesn't matter: the economy can only sustain the 19% of GDP level for any length of time. If politicians want more dollars to spend, they should choose whatever method of taxation boosts the economy most. Cutting taxes across the board seems to do just that.

Oh, but what about the deficit, you ask? I'm not entirely sure deficits matter but could fiscal responsibility demands we do keep an eye on it. Here's how to balance the budget without really trying:

The CBO, the non-partisan agency charged with estimating the effects of legislation on government costs, has produced a long-term budget outlook in which Bush-era tax rates remain unchanged. Their conclusion is that over the next decade, "government revenues would remain at about 19 percent of GDP, near their historical averages." That's actually a bit higher than the historical average, but is within the bounds of reason.

A balanced budget in 2020 based on 19 percent of GDP would mean $1.3 trillion in cuts over the next decade, or about $129 billion annually out of ever-increasing budgets averaging around $4.1 trillion. Note that these are not even absolute cuts, but trims from expected increases in spending.

Short version: you can still have a mighty big Federal government with spending at 19% of GDP.

Somewhat related and entirely prescient. This idea isn't new. From October 8, 2008:

(L)ower taxes = higher GDP. Higher GDP = better for everybody.

I wonder how much GDP has changed since Obama took office? Surely 19% of a diminishing number which is required to support a growing entity must have problems.

ReplyDeleteI mean, if GDP shrinks while the government itself (salaries, pensions) grows, there is an acute problem, no?

Agreed. I don't have numbers about GDP since Obama took office but I'm reasonably certain it hasn't increased significantly. The new tax deal should change that.

ReplyDeleteNot that my profligate state has any lessons to offer. Rational people around here have only one hope which they're calling the Brown goes to China moment: They're hoping that Jerry Brown, having nothing to lose at his age will get some sort of fiscal religion and "fix his legacy."

ReplyDelete